SECURE 2.0 Act Changes RMD Rules

RMD Age Increase

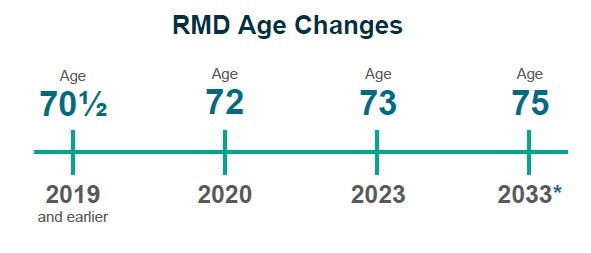

The SECURE 2.0 Act increases the RMD age from age 72 to age 73 in 2023, and then to age 75 in 2033* (or the year of retirement, if later, for certain plan participants who are not 5 percent owners). Individuals born in 1950 or earlier are unaffected by this change and must take any RMDs due for 2022 and later years.

Effective Date

This provision is effective for distributions required in 2023 and later years, for those who reach age 72 after December 31, 2022.

More RMD Changes are Coming in 2024

Beginning in 2024, the SECURE 2.0 Act exempts designated Roth account assets in 401(k), 403(b), and governmental 457(b) plans from pre-death RMD rules. As a result, designated Roth account assets will no longer be included in the RMD calculation. This provision applies to pre-death RMDs due for 2024 and later tax years.

The SECURE 2.0 Act does not clearly indicate whether participants can distribute designated Roth account assets in order to satisfy their RMD. In general, it appears that designated Roth assets may not be used to satisfy an RMD during a participant's lifetime. Additional IRS guidance is needed to clarify this provision.

* Due to a drafting error in the bill, individuals born in 1959 have an RMD age of both 73 and 75.

A technical correction will be needed.

Click here for a pdf copy of this article.