Employer Tax Credits, Part 2

Click here for a pdf version of this article.

Start-Up Credit

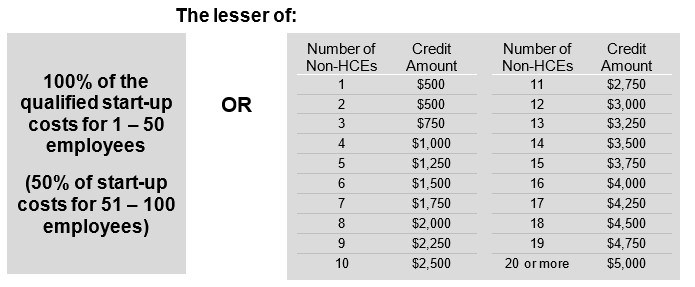

100% Credit for Some Small Employers; 50% Credit for Others

The start-up credit can be used for a period of up to three years and applies to 401(a) defined contribution plans (including 401(k) plans) and defined benefit plans, 403(a) annuity plans, SEP plans, and SIMPLE plans. An employer may elect to apply the credit to the year that the plan is established or to the year before establishment. Assuming that they meet all other IRS requirements, eligible employers who generally have no more than 50 employees —and have at least one non-highly compensated employee who is eligible to participate—are eligible for the maximum credit of 100% of qualified start-up costs, up to $5,000.

NOTE: The 50% credit for employers with 51 - 100 employees, as modified by SECURE 1.0, is generally unchanged.

Credit Formula

Example 1

ABC Company started a plan in 2023 and incurred $4,200 in plan start-up costs during the year. ABC Company has 40 employees who received at least $5,000 in compensation from ABC Company in 2022, and 36 are non-highly compensated employees(non-HCEs). Because ABC Company has more than 20 employees, the potential credit (on the right side of the chart) is $250 for each of the first 20 employees. Under the new law, the credit is the lesser of ABC Company’s start-up costs ($4,200) or $5,000. Because the actual start-up costs are less than $5,000, the credit amount is $4,200.

Employer Contribution Credit

The contribution credit applies to 401(a) defined contribution plans (including 401(k) plans), 403(a) annuity plans, SEP plans, and SIMPLE plans. This employer credit does not apply to defined benefit plans.

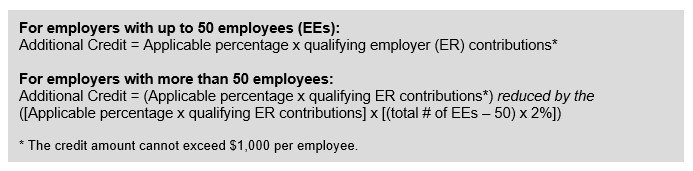

The contribution credit is a percentage of employer contributions, up to $1,000 per employee, and applies to small employers that adopt a new retirement plan and make contributions for their employees. Employers cannot consider contributions made to employees that make more than $100,000 in FICA wages for the year (indexed). Subject to these limitations, employers can receive a credit of 100% of eligible contributions for the first and second years in which the plan is effective with respect to the eligible employer. The credit is reduced to 75% of eligible contributions in the third year, 50% in the fourth year, 25% in the fifth year, and zero for any taxable year thereafter.

The full credit is available to eligible employers with 50 or fewer employees. The credit is phased out for employers with 51 to 100 employees. Specifically, the credit shrinks by 2% for each employee over the 50-employee threshold.

Credit Formulas

Example 2

Assume that XYZ Company has 70 employees, and they all make under $100,000 in FICA compensation. XYZ Company makes a $1,500 contribution to each employee.

To determine the contribution credit in the first year of the employer’s eligibility, XYZ Company multiplies 70 employees by the $1,500 contribution for a total of $105,000, which multiplied by the applicable percentage of 100% is still $105,000. However, because the employer cannot receive a credit for more than $1,000 per employee, the credit is reduced to $70,000. Further, because XYZ Company has over 50 employees, it must reduce the amount of the credit by multiplying the number of employees over the 50-employee limit (20) by 2% for a total of 40%. XYZ Company must then multiply $70,000 by 40% to determine the amount by which the credit must be reduced, which is $28,000. The credit for the first year equals $42,000 ($70,000 - $28,000).

Assuming that the number of employees stays the same, the credit will be the same for the plan’s second year.

Additional Details on the Start-Up and Contribution Credits

Who is an eligible employer?

To be eligible for this credit, an employer must have had no more than 100 employees (or 50 employees, for the 100% start-up credit) who received at least $5,000 in compensation during the year preceding the first year of the employer’s three or five year credit eligibility period, as applicable. The employer must also remain within the applicable employee threshold or fall within the two-year grace period for the taxable year for which the credit is claimed.

What are qualified start-up costs?

Qualified start-up costs include any ordinary and necessary expenses of an eligible employer that are paid or incurred in connection with

- the establishment or administration of an eligible employer plan, or

- the retirement-related education of employees with respect to such plan.

For example, costs associated with determining whether to establish a plan are not considered qualified start-up costs. But paying a TPA to administer the plan and hiring a firm to educate employees about the plan are qualified costs. Because qualified and nonqualified costs sometimes seem to overlap or are not always clear, employers should consult a tax professional to determine qualified start-up costs.

Can an employer carry forward qualified start-up costs and claim them in a later year?

No. The credit applies to qualified start-up costs paid or incurred by the employer during the taxable year. So start-up costs that exceed the maximum credit cannot be used up in subsequent years.

Can an employer claiming the start-up credit take a tax deduction for the same qualified start-up costs?

No. An employer claiming this credit cannot also take a deduction for the portion of qualified start-up costs equal to the determined credit amount. Although this is strictly a tax question, it appears that start-up costs that exceed the credit limits are eligible for a deduction.

Additional Examples: Start-up Credit

Example 3

Jack Flash is the sole owner (and only employee) of Jack Flash Consulting. Jack establishes an Individual(k)™ plan and pays a third-party administrator $1,000 to supply the plan document and to administer the plan. What credit is available to Jack for these plan start-up costs? None. An employer must have at least one non-HCE to be eligible for the start-up credit.

Example 4

Acme Company started a 401(k) plan in 2023 and has 75 employees who made at least $5,000 in the prior year. Acme Company’s tax advisor has determined that start-up costs for the year total $12,000.1 The start-up tax credit is 50% of start-up costs ($6,000) or $5,000, whichever is less. So Acme Company’s credit for 2023 is $5,000. Acme Company cannot carry over the unused startup costs from 2023 for which no credit was received into the 2024 tax year. Instead, Acme Company may use only the actual 2024 start-up costs (e.g., administration and education) to determine the 2024 credit.

1These costs merely illustrate the credit calculation and do not reflect typical costs.

Additional Examples: Employer Contribution Credit

Example 5

Jan Jones owns Flagstaff Consulting, which is a subchapter S corporation. Flagstaff has 10 qualifying employees in addition to Jan, who pays herself $30,000 in W-2 wages (and $500,000 in dividend compensation). Her five consultant employees each make more than $200,000 per year in 2023. Her other five employees each earn between $50,000 and $90,000. Because 2023 was such a profitable year, Jan establishes a SEP plan and gives each employee a 10% contribution. In addition to a possible start-up credit, Flagstaff is also eligible for the employer contribution credit. How much will it be?

The contributions to those earning more than $100,000 in FICA wages cannot be considered, so only contributions to those earning less than that amount are used. The contributions for the five employees earning up to $90,000 range between $5,000 and $9,000. But only the first $1,000 of contributions to each can be considered in the first (and second) years of credit eligibility. In addition, although Jan’s total compensation is well over $100,000, her W-2 compensation—which is her only income that is subject to FICA withholding—is only $30,000. So, her $3,000 (10% of $30,000) SEP contribution is also considered, but only up to $1,000. Because Flagstaff has no more than 50 employees, it is eligible for 100% of the credit amount for the 2023 contributions made to the six Flagstaff workers who earned less than $100,000 in FICA wages. Therefore, Flagstaff’s employer contribution credit for 2023 is $6,000.

Example 6

Angel Angle Iron Corporation has 95 employees. Angel’s HR Director is pleased because the company has fewer than 100 employees, which means it qualifies for the employer contribution credit for the plan’s first year. But she realizes that the credit is 100% of a reduced amount because Angel has more than 50 employees.

Let’s assume that Angel makes a total of $60,000 in eligible employer contributions. (No contributions to anyone earning over $100,000 in FICA wages can be taken into account and the credit cannot ultimately exceed $1,000 per employee.) This $60,000 must be reduced by the number of employees exceeding the 50-employee limit (45 employees), which is then multiplied by 2%.

Employer contribution credit = $60,000 reduced by [$60,000 X (45 X 2%)]

$60,000 – [$60,000 X 90%]

$60,000 – $54,000 = $6,000

Although this credit is still available for employers that start a new retirement plan and that make contributions to employees, the phase-out rules for employers with more than 50 employees reduces the available credit.

Conclusions

The increased credit for plan start-up costs and the new credit for employer contributions for start-up plans give employers a chance to adopt a new plan with little or no out-of-pockets expenses for the first few years. These incentives could be enough to nudge them to establish a plan. But as some of these examples illustrate, even a seemingly straightforward provision can get complicated. While it may be helpful to point out the many advantages presented by the new rules, the details of applying the rules and actually filing for the credit should be done with the assistance of tax professionals.

Click here for a pdf version of this article.